Personal finance decision-making generally involves making difficult decisions, and one of these is whether to pay off your debts or save for an emergency. Since both are important in ensuring financial security, it may be seen that most people struggle with: Is it better to pay credit card/debt off or have an emergency fund? In order to answer this question, one has to know the roles which each of them plays in your financial life.

The Case for Paying Off Debt

Debt, for most, can actually be a burden. Hence, we have debt facilities like credit card balances, which are easy to trigger and hard to control and, therefore, result in a cycle of worry. In such situations, choosing to focus on paying back the debts has its benefits for the following reasons:

Reducing Financial Stress

Debt is stressful and results in worry that will reduce the quality of life that an individual has. Debt reduction is liberating and makes people feel happier.

Interest Savings

The longer you have that debt, the more interest you will have to pay. For instance, credit card debt attracts interest rates of up to 20% or even higher. It is possible to save money by constantly paying off debts.

Improved Credit Score

Debt decreases credit scores when the former is high. Credit utilization calculates the amount of credit borrowed and then paid off, and having a low amount can make you look creditworthy.

The Importance of an Emergency Fund

On the other hand, having an emergency fund can give a security blanket for the family. It can shield you from a life event you did not plan, like a car breakdown, a medical bill or unemployment. Highlighting the reasons why having an emergency fund is equally essential:

Financial Security

It is wise to have an emergency fund since it offers a measure of security. This means that when you know you are likely to have some amount of cash as an emergency fund you don’t have to worry much about the future.

Avoiding More Debt

With no savings, it becomes difficult not to spend the money in other ways leaving you in more credit card or loan debt. It is helpful to have some savings to be able to pay for these expenses without increasing the amount of debt.

Flexibility

An emergency fund can be a real plus in your financial planning since it is very fluid. It enables you to make choices without immediate threats of incurring more debts in the process.

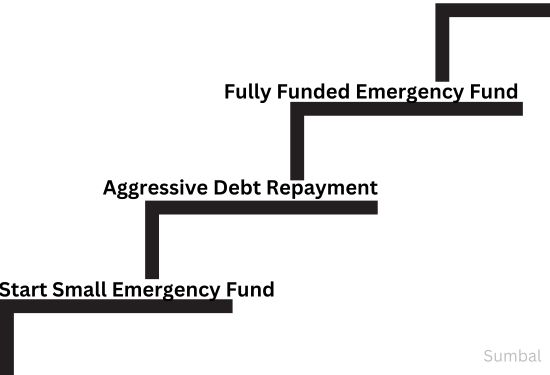

Finding a Balance

We can consider these points for creating harmony in this situation;

Start with a Small Emergency Fund

Aim to save $1,000 for those little accidents that wouldn’t justify a full-blown insurance policy. This is an important cushion that helps you avoid all sorts of temptations as you accumulate your money to pay back the money that you owe.

Aggressive Debt Repayment

Any more money should be used to pay off high-speed interest debt with even greater intensity. This strategy reduces the incidence of interest while striving to eliminate liabilities in the company.

Increase Emergency Fund Gradually

After paying down a considerable amount of debt, you need to concentrate on saving your emergency funds for between ninety to one hundred and eighty days of your living expenses. This can cover all and every aspect of your financial security in future.